Taiwan Semiconductor Manufacturing Company (TSMC) has once again secured its position among the world's top 10 most valuable companies. This resurgence is fueled by the ongoing optimism surrounding artificial intelligence (AI) and its profound impact on the tech industry, which has propelled TSMC's stock to unprecedented heights.

According to a Bloomberg report, TSMC's stock experienced a remarkable rally of 14% last week. This surge elevated the chipmaker's market capitalization to a record level. While an early trading decline of 2% on Monday, March 11, slightly reduced the valuation to $634 billion, the company's overall market share remains higher than that of Broadcom.

Analysts' Perspectives

Experts from Morgan Stanley and JPMorgan Chase & Co. anticipate further growth for the semiconductor giant. With major clients including Apple, Nvidia, and Qualcomm, TSMC is expected to benefit from increasing AI-related revenue and robust pricing power.

Charlie Chan and other Morgan Stanley analysts noted the significance of generative AI for TSMC's growth. The company's strategic overseas expansion also plays a crucial role in mitigating geopolitical concerns.

The demand for high-end chips, spurred by the surge in AI activity, has contributed to TSMC's revenue growth of 9.4% in the first two months of 2024.

Nvidia's 'AI Boost'

Nvidia has also experienced a significant stock increase this year, driven by the generative AI trend.

Over the past month, Nvidia's stock price has surged by over 20%. In the last six months, it has increased by over 90%. Over the past year, Nvidia's stock price has risen from $234.36 per share to $875.28 per share, marking a 275% increase.

Newer articles

Older articles

Hetmyer's Heroics: Orcas Stun MI New York with Last-Ball Six in Record-Breaking MLC Chase

Hetmyer's Heroics: Orcas Stun MI New York with Last-Ball Six in Record-Breaking MLC Chase

Android Users Face Critical Security Risks: Update Your Devices Now, Warns Government Agency

Android Users Face Critical Security Risks: Update Your Devices Now, Warns Government Agency

Greg Chappell Hails Rishabh Pant's "Revolutionary" Batting, Likens Him to Gilchrist

Greg Chappell Hails Rishabh Pant's "Revolutionary" Batting, Likens Him to Gilchrist

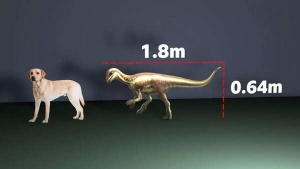

Dog-Sized Dinosaur Fossil Unearths New Insights into Prehistoric Life Alongside Giants

Dog-Sized Dinosaur Fossil Unearths New Insights into Prehistoric Life Alongside Giants

West Indies Captain Chase Slams Umpiring After Test Loss, Demands Accountability

West Indies Captain Chase Slams Umpiring After Test Loss, Demands Accountability

IRCTC's AI Chatbot, AskDisha 2.0, Streamlines Train Ticket Booking, Refunds & Information

IRCTC's AI Chatbot, AskDisha 2.0, Streamlines Train Ticket Booking, Refunds & Information

Freestyle Chess India Event Scrapped Due to Sponsorship Issues; Carlsen Absence Confirmed

Freestyle Chess India Event Scrapped Due to Sponsorship Issues; Carlsen Absence Confirmed

Moto G54 Gets Significant Price Drop in India: Check Out the New Affordable Price Tag

Moto G54 Gets Significant Price Drop in India: Check Out the New Affordable Price Tag

New Zealand Cricket Announces Packed 2025-26 Home Schedule Featuring Australia, England, West Indies & South Africa

New Zealand Cricket Announces Packed 2025-26 Home Schedule Featuring Australia, England, West Indies & South Africa

Converting JPG to PDF: A Comprehensive Guide for Preserving Image Quality and Ensuring Accessibility

Converting JPG to PDF: A Comprehensive Guide for Preserving Image Quality and Ensuring Accessibility